Of course, this is a silly question on its face. Who do you think designs abusive tax shelters, other than tax accountants and tax attorneys? Now, in a new study by the Tax Justice Network, we see that there is a positive correlation between a jurisdiction's (remember, not all tax havens are independent countries) secrecy index and the number of banks and Big Four accounting firms (PwC, Ernst & Young, KPMG, and Deloitte) per capita present there. The report documents one "leveraged partnership transaction" that PwC both designed and then pronounced to be legally valid (in what is usually termed an "opinion," for which it was paid $800,000), which the U.S. Tax Court strongly criticized as a "conflict of interest" when it upheld the Internal Revenue Service's squashing of this arrangement.

More specifically, we find that the Cayman Islands had the third most Big Four accounting offices per 1000 population at 0.95, compared with just .001 per 1000 for the United States (see Graphs 4 and 5, p. 24, in the report). This density is almost 100 times higher in the Caymans than in the U.S. The Caymans also had more than twice as many banks per 1000 as any other country, at 4.5 per 1000, compared to .023 per 1000 for the U.S. (Graphs 1 and 2). The graph below shows Big Four offices per 1000:

Source: Tax Research UK

Note, too, that Bermuda (which the Romneys also have used) comes in at about .06 per 1000 population, or about 60 times the U.S. rate.

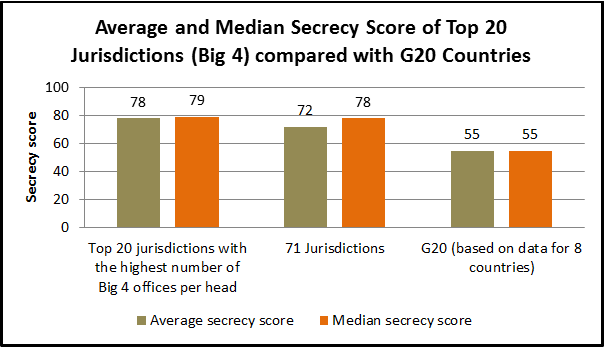

Similarly, we find that comparing the secrecy score of the 20 worst tax havens with the Tax Justice Network's broader list of 71 tax havens and with the G-20 nations shows a much higher mean and median secrecy score in the tax havens than in the non-havens, as the next graph shows.

Source: Tax Research UK

As Richard Murphy, one of the authors of the report, comments at Tax Research UK:

This research lets us conclude that working in conditions of secrecy has become an inherent part of the work of bankers and accountants. It suggests that this has led to a culture of creative non-compliance with laws and regulations, which is likely to increase the potential for, and volume of, crime. At the same time, banks’ and Big 4 firms’ lobbying for laws and regulations that reduce transparency is likely to have resulted in further opacity in the world’s financial system.This, then, is the world in which Mitt Romney travels, a world in which accounting firms actively seek to create tax avoidance opportunities with little concern for whether they step outside the law's boundaries, and in so doing facilitate the transfer of the tax burden from the 1% to the 99%. In my opinion, PwC's assurances about Romney's tax situation are not worth the paper they're printed on.

Bonus question for President Obama to pose in the third debate: Why is the "McCain precedent" (2 years of tax returns) more important to you than the George Romney precedent (12 years of returns)?

"Romney Exposed" - The Most Secretive Man to Run for President! http://tinyurl.com/99nyuwd

ReplyDeleteThis Video goes into detail why Romney won't release his tax returns.

Not divulging his tax return certainly came at a cost for Romney. What, then, would the cost of actually releasing those tax returns have been? For a pragmatist like Romney, I'm led to believe that it would have been much greater.

ReplyDeleteIf one of my tax undergrad students wrote a commentary this ridiculous it would be slashed with red ink and returned for a rewrite.

ReplyDeleteIf one of my students cited the Tax Justice Network as an expert source I would send the paper back.

If one of my students made broad sweeping generalizations, such as directed at PWC and the Big 4, I would mark up the paper and send it back for some evidence and some clear thinking. (I have no connection to PWC and don't care much for the Big 4 in general).

I don't care much for Mitt Romney either, but this screed is ridiculous. This is an opinion piece disguised as scholarship.

If a student quoted from Richard Murphy's work published by Cornell University Press, would it make you happier? It's the same Richard Murphy, who consults for Tax Justice Network.

DeleteThis is a blog post, not a journal article. I was trying to make one simple point: just because a Big 4 accounting firm says something, does not make it so. This is especially true in this case because it basically didn't say *anything*, like tell us how much Governor Romney made or paid in taxes in any given year. All it did was average the rates PwC claims he paid.

And I stand by my implication that accounting firms consider paying penalties a cost of doing business. If aggressiveness net of penalties didn't pay, they wouldn't be aggressive.

Irrelevant. Class envy solves nothing. Redistribution does not work, has never worked and will never work. You silly redistributionists want ignorant Americans to buy into this asinine idea that wealth can be created simply by taking it from the wealthy and "spreading it around." That's about as stupid as thinking that by taking a bucket of water out of the deep end of a pool and pouring it in the shallow end, you have made the shallow end deeper. Socialism does not work!

ReplyDeleteAs Warren Buffett says, "Class warfare exists and my side won." To put it another way, our current income distribution in the U.S. is the result of a lot more than market forces. Specific tax policies sought and obtained by the rich have sharpy reduced their share of the tax burden. There is nothing morally wrong with wanting to reverse those policies.

DeleteMoreover, market outcomes themselves are not necessarily "just," either. People who "earned" their money by creating monopolies do not deserve our moral approval. At least that's what Adam Smith thought.

Wow, all of this effort to dissect a successful guy's, 100% legal, personal tax returns. All I can say is wow and thank goodness the author isn't a loser, desperately seeking to help Obama'r re-election efforts.

ReplyDeleteWe only have his word that the tax returns were 100% legal. Why won't he show us, as his dad pioneered?

DeleteWe do know that when he ran for Governor of Massachusetts he claimed to have been a resident of the state for tax purposes, but it turned out he had been claiming tax residency in Utah instead, and had to retroactively change that and pay back taxes to Massachusetts. Why should we believe him now when he lied then?

Thanks for stopping by.

Haha, looks like the Romney bots came back to hit this post, too!

ReplyDeleteBEWARE the bots and cyber-thugs that hit progressive sites with flamers.